Check out the newest insights: Why retail investors urge for crypto services - Get it now.

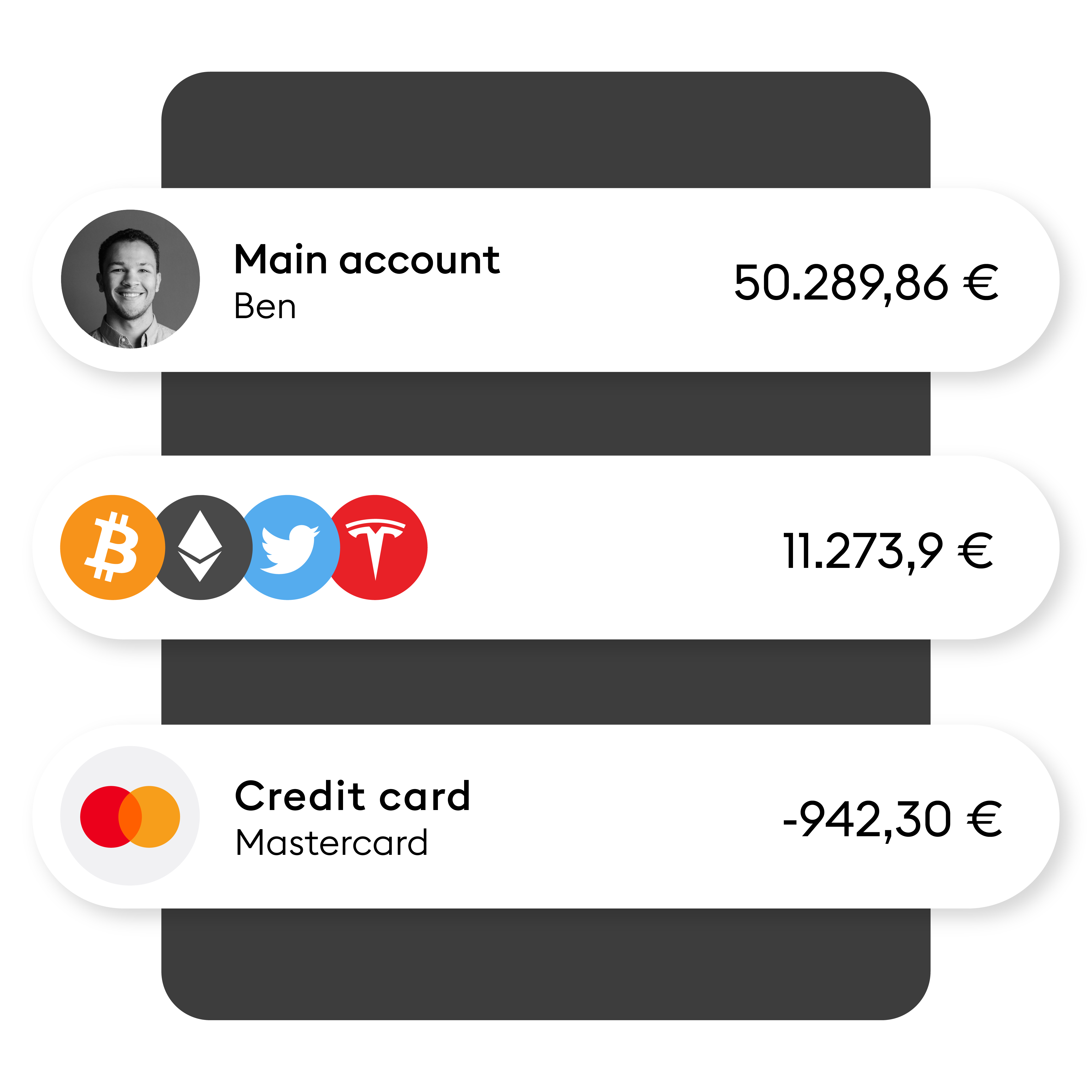

Our goal is to enable you in delivering the highest quality user experience. 20+ million customers already have access to investing through us. Join them and kick-start your investing feature.

We support any use case from traditional banks, to fast growing fintechs, to neobanks and online platforms

We are working with leading financial institutions, unicorns, top-tier banks and everyone in between. Here you can find a selection of case studies to find out what they're building and how we are helping them.

Highlighted news

The bank plans to offer its customers a broad range of cryptocurrencies, stocks, ETFs, precious metals, and commodities through Bitpanda's SaaS offering.

The partnership will begin with RLB NÖ-Wien, allowing it to take the lead among traditional EU credit institutions.

Description: financial super-app from France.

Need: Lydia wanted to offer cryptocurrencies, Stocks*, ETF*s and metals, without the need to integrate with several providers, and launch its new investing feature ahead of the market.

Solution: By leveraging our multi-asset APIs, Lydia launched Stocks*, Crypto and Metals to 6+ million customers in France, launching as planned.

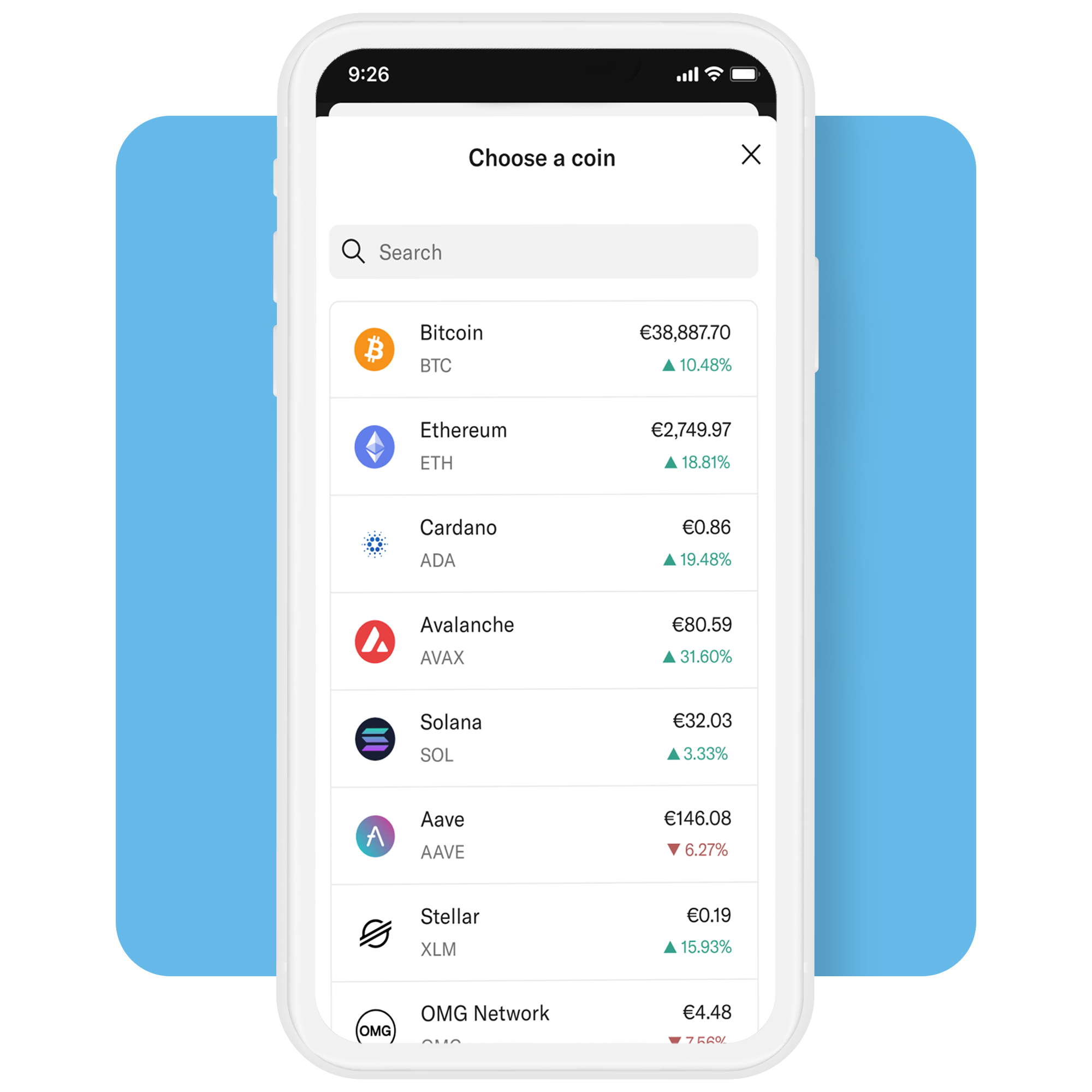

Description: Leading neobank from Germany.

Need: N26 wanted to offer crypto assets across multiple markets in Europe as a highly regulated bank.

Solution: Bitpanda made it possible for N26 to offer a broad range of crypto assets in a regulatory compliant way via Bitpanda's API solution, and go live in all selected markets.

Description: Personal finance app from the UK.

Need: Plum wanted to make cryptocurrencies and metals available to its European client base in three markets.

Solution: Plum seamlessly integrated the API, making use of the investing infrastructure expertise of Bitpanda and rolled out in all three markets.

Description: Challenger bank from Italy.

Need: Hype wanted to enable its users to invest in fractionalised Stocks*, ETF*s and metals from €1 and achieve a unique positioning in the Italian market.

Solution: Hype launched a seamlessly integrated investing feature in line with local regulations and enabled its customer base to invest in 2500+ Stocks* & ETFs* and Metals.

P.F.C.

P.F.C.Description: Challenger financial services from Sweden

Need: P.F.C. strives to allow its users to invest in crypto from 25 SEK, improving their unique position in the Swedish market.

Solution: Beginning their mission in 2018 P.F.C. believes that great technology and design will enable a better everyday experience of managing your money.

iCard

iCardDescription: Innovating non-bank electronic solutions

Need: iCard and Bitpanda have partnered to bring Crypto & Metals investments directly to iCard users' e-wallets. Using Bitpanda's advanced API, iCard will offers a seamless way for users to diversify their portfolios.

Solution: Utilizing our advanced multi-asset APIs, iCard will launch Crypto and Metals for its Italian customers, and introduce Crypto services in Bulgaria. This move showcases iCard's commitment to enhancing investment options for its 1.8 million users across Europe.

Reach out to us and get started today.

*Bitpanda Stocks is a product on the part of Bitpanda and enables investing in partial shares/ETFs. Bitpanda Stocks are not shares, but a contract that allows you to participate in the price movements of certain shares, including any dividend payments. The financial instrument Bitpanda Stocks is neither tradable on stock exchanges nor on other trading places, but can be resold to Bitpanda at any time under the conditions stated in the GTC and the contracts.